Table of Contents

- How the Bond Market Works - YouTube

- Raj Times and Cycles: Did we see a major Interest Rate Bottom and Bond ...

- What is the Bond Market? - Intuition

- Bond market remains underdeveloped despite years of existence

- Stock Market And Bond Market Difference at Harry Carey blog

- What’s the Deal with Surging Bond Yields? | J.P. Morgan

- Bond Market - Meaning, Examples, Types, Pros and Cons

- Bond Market is Shown Using the Text and Picture of Central Bank and ...

- Business Insider: A bond market insider explains why the market is ...

- Value has returned to bond markets

What are Bonds?

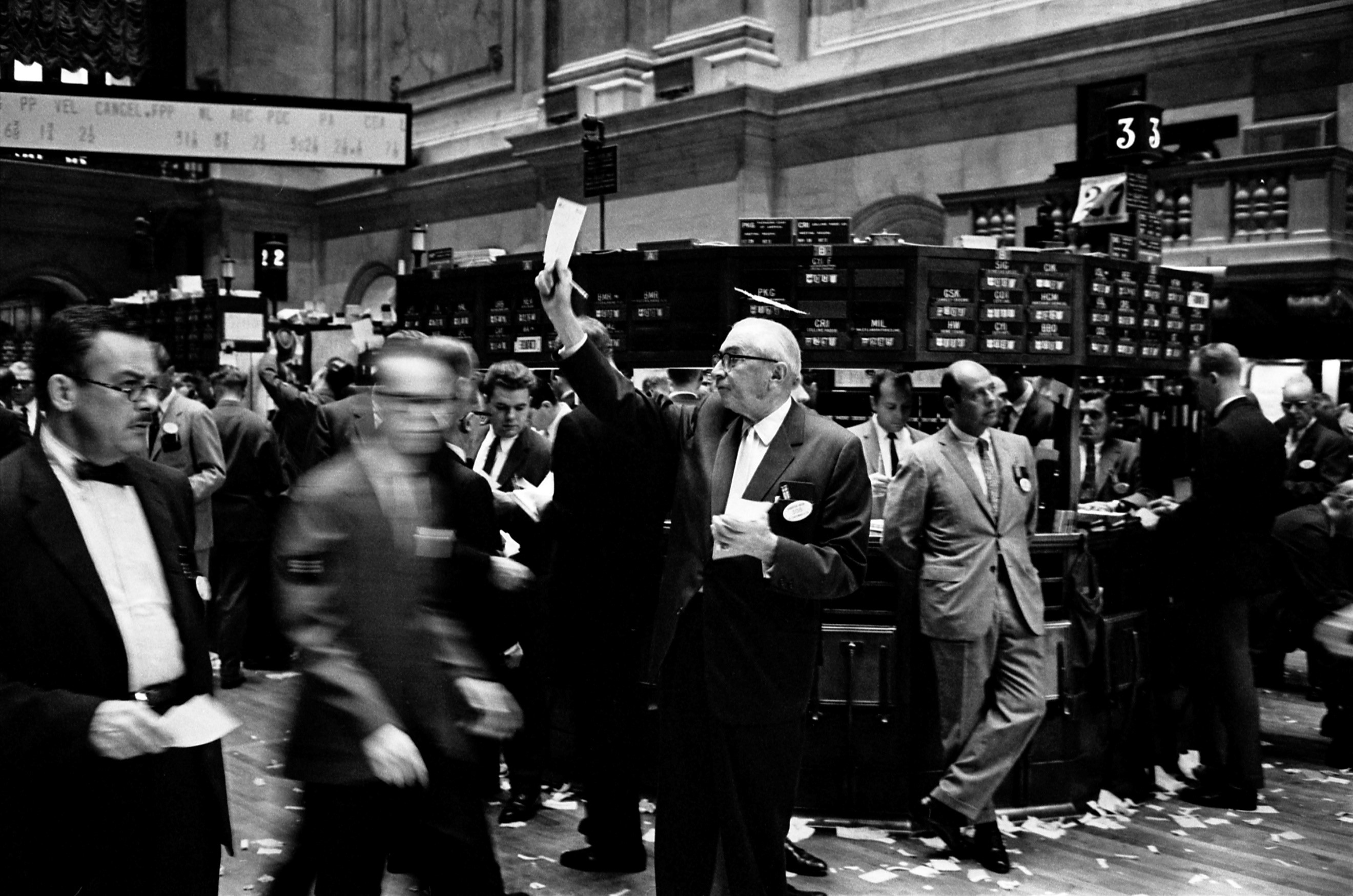

The Bond Market

Bond Prices and Rates

Bond prices and rates are closely linked. When you buy a bond, you pay a price, which is typically expressed as a percentage of the bond's face value. The price you pay will determine the yield, or return, you receive on your investment. The yield is calculated by dividing the annual interest payment by the bond's price. For example, if you buy a bond with a face value of $1,000 and an annual interest payment of $50, and you pay $900 for the bond, the yield would be 5.56% ($50 ÷ $900).

Types of Bond Rates

There are several types of bond rates, including: Coupon Rate: The interest rate paid periodically to bondholders. Yield to Maturity: The total return on investment, including interest payments and capital gains or losses. Current Yield: The annual interest payment divided by the bond's current price.